How to Spot a Synthetic

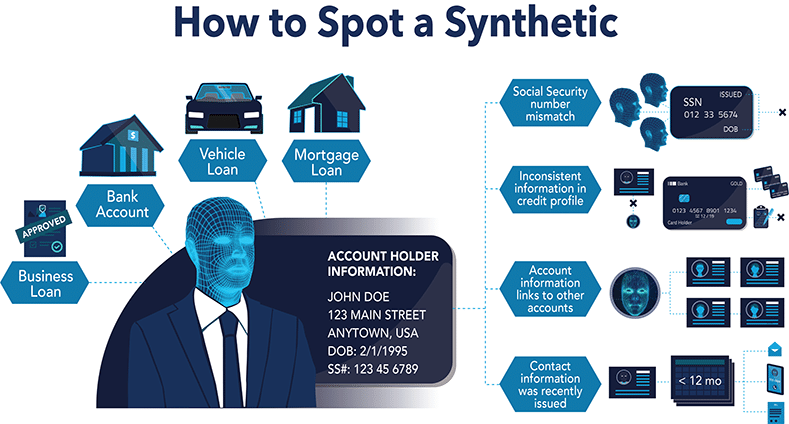

Greater awareness of synthetic identity fraud is an important first step toward detecting and mitigating it. One challenge is that these identities are created to look and act like a legitimate person or entity – so they often pass initial identity verification. It is important to look deeper, both within individual accounts and across accounts, to determine if the information around the identity makes sense.

Typically, no single indicator signifies a synthetic identity. Rather, a combination of multiple characteristics may suggest a potential synthetic identity and help determine if additional review is needed. Both awareness and review of these characteristics are critical for organizations to begin identifying synthetic identity fraud.

Within a customer application or account, characteristics that may warrant additional investigation of the identity include:

- Large amount of unsecured debt (which requires less documentation than a mortgage, for instance)

- High number of recent credit inquiries, which could indicate the fraudster is attempting to quickly build credit

- Mismatch between the accountholder’s age and duration of credit history

- Inflation of credit file depth

- Suspicious mailing address

- Recently issued contact information

At times, something may not seem suspicious by itself, but certain red flags may begin to appear when looking at the information in aggregate. Similar customer information across accounts is the biggest indicator. Specifically, you should look for accounts with:

- Similar or matching contact information (address, phone, email address, etc.)

- Matching Social Security numbers

- Identical digital footprint

Test Your Knowledge

Synthetic identity fraud can be difficult to detect because the synthetics created by fraudsters appear to be real customers, and often, these identities pass Know Your Customer (KYC) verification. Review scenarios of account applications and see if you can spot the synthetics.

Downloadable Resources

Explore these resources on protecting yourself from synthetic identity fraud and tips on what to do if personal information has been put at risk.

| Document Title | Format | Reading Time |

|---|---|---|

| How to Spot a Synthetic (PDF) | Document | 7 Minutes |

| How to Protect Your Personal Information (PDF) | Document | 5 minutes |

| Protecting Your Kids From Synthetic Identity Fraud (PDF) | Document | 4 minutes |

| Protecting Yourself From Popular Scam Tactics (PDF) | Document | 5 minutes |

| What to do if Your Personal Information is Compromised (PDF) | Document | 2 minutes |

The synthetic identity fraud mitigation toolkit was developed by the Federal Reserve to help educate the industry about synthetic identity fraud and outline potential ways to help detect and mitigate this fraud type. Insights for this toolkit were provided through interviews with industry experts, publicly available research, and team member expertise. This toolkit is not intended to result in any regulatory or reporting requirements, imply any liabilities for fraud loss, or confer any legal status, legal definitions, or legal rights or responsibilities. While use of this toolkit throughout the industry is encouraged, utilization of the toolkit is voluntary at the discretion of each individual entity. Absent written consent, this toolkit may not be used in a manner that suggests the Federal Reserve endorses a third-party product or service.